What you don’t desire is the use of extreme amounts of financial obligation, which is actually what puts companies at high risk for bankruptcy. My number two, I think I’m torn in between more openness so that we understand more about what these private equity funds are doing, and a guaranteed severance for workers.

What frequently takes place is private equity can be found in and loads a portfolio company up with financial obligation. In some way the portfolio business now needs to get the cashflow up so that it can now make the financial obligation payments. And the most convenient method to do that is to cut worker hours, work, or advantages. Please note: Although this chart might indicate otherwise, IPOs are not the peak of all (and even most) businesses. Numerous businesses will start, grow, and pass away with private capital. Not all private equity is equal. There are countless private equity firms in the United States ranging in size. CapIQ, the finance market’s top database for market intelligence, reports 2666 private equity companies in the United States.

The chart below screens the data. The chart reveals the variety of private equity companies throughout the country. There are 279 firms with funds over $1B, 346 companies with funds less than $50M, and 1171 in between. On top end, there are the industry giants of KKR, Blackstone, Carlyle, and so on. invested $ million.

These are the offers you read about in the paper. Although they are a minority of private equity deals, they receive the majority of journalism. At the lower end, there are private equity firms that invest $1-2 million in privately-held organisations. Your preferred coffee roaster or the local production plant could be private equity-controlled.

The Working Person’s Guide To The Industry That Might Kill

Many firms will just consider business that run in a specific sector or geographical area. What’s the distinction between private equity-owned and private equity-controlled? A private equity firm is hardly ever the sole owner of a company but is often the majority owner. Private equity firms normally control 60-80% of a business.

Although these organisations are frequently described as “private equity-owned” they could more properly be believed of as “private equity-controlled.” Private equity firms raise funds of capital that invest in companies. The capital in the funds come from Limited Partners (LPs) and General Partners (GP). About 90% of a fund’s capital originates from LPs.

Examples of LPs are insurance companies, trusts and endowments, pension funds, high net worth people, and banks. They are not included in the fund daily. It is merely a financial investment car for their capital (securities fraud racketeering). GPs are people who run the fund as their day task. Lots of GPs have histories as bankers, accountants, or portfolio supervisors.

The capital in the fund is used to invest in business. When those business are offered the earnings is distributed between the LPs and GPs. LPs generally get 80% of the favored return (if any). GPs navigate 20% of the capital gains (if any). They likewise make a management charge on the fund’s capital 2% is standard.

Should Your Restaurant Partner With A Private-equity Firm

They evaluate a a great deal of deals but a really small percentage gets closed. The majority of private equity companies have multiple funds of capital. Each fund follows a timeline comparable to this: The very first couple years is invested raising the capital that will create the fund. As fundraising concludes, GPs deal with their deal sources to discover companies they are interested in buying.

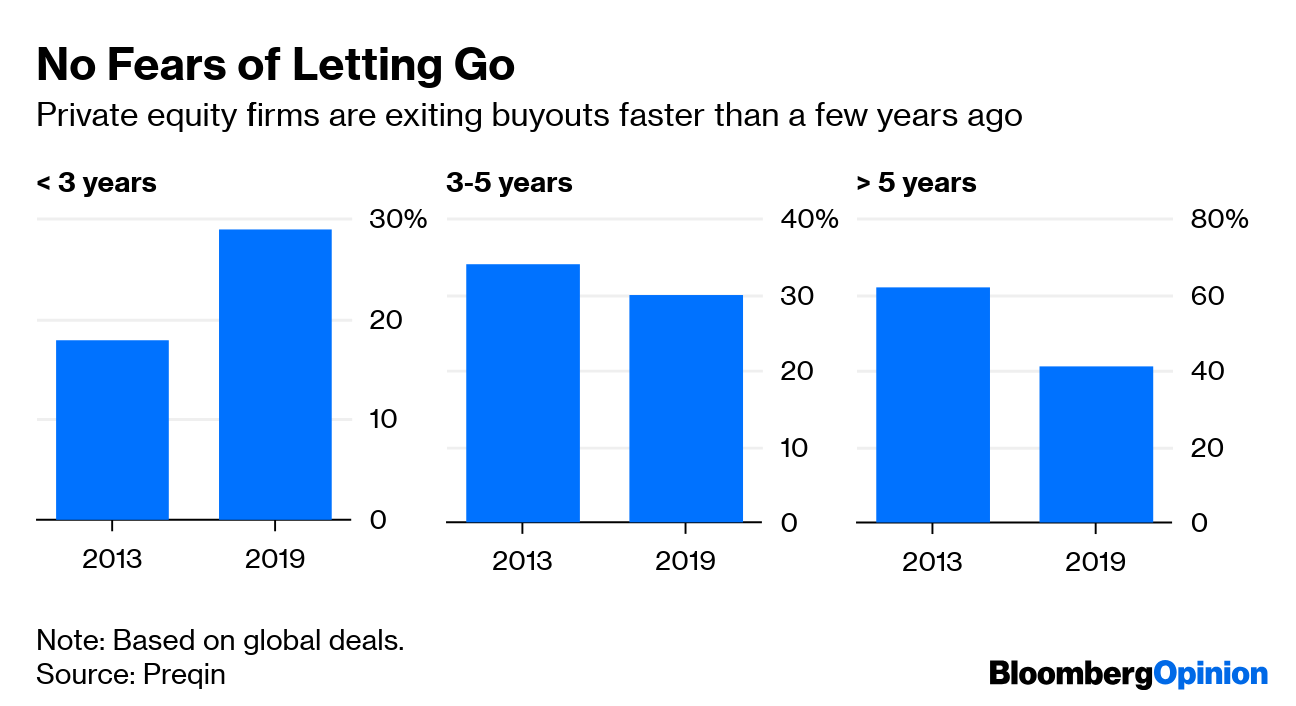

When the GP sees that an exit can produce a rate of return that would fulfill or surpass the LPs expectations, they will offer the organisation. Lots of funds have a 10-year life process. Although, that has been changing over the last few years with some funds selecting life process closer to 15 or 20 years.

These funds work on various timelines. state prosecutors mislead. A private equity firm can be raising cash for one fund while leaving a business to make a return on a various fund as can be seen in the chart below. Simply as each fund has a general life cycle, private equity firms follow a general cycle for each company they buy.

Particular funds can have their own timelines, financial investment objectives, and management approaches that separate them from other funds held within the very same, overarching management firm. Effective private equity companies will raise lots of funds over their lifetime, and as companies grow in size and complexity, their funds can grow in frequency, scale and even specificity. For more information about real estate investing and also - research the videos and -.

Tyler Tysdal is a long-lasting entrepreneur helping fellow business owners offer their business for optimum value as Managing Director of Freedom Factory, the World’s Best Business Broker located in Denver, CO. Flexibility Factory assists entrepreneurs with the most significant deal of their lives.

When the company has actually grown to a point where the fund will make a satisfying rate of return on the sale, the firm will sell their stake in business. nfl free agent. What is a” Buy & Hold” strategy?Some private equity firms will mention that they have a “buy & hold” method. This indicates that the firms do not purchase organisations with a specific exit timeline in mind they will own business for an undetermined quantity of time.

Private Equity Firms Are Becoming Lenders. Here’s Why

There are 5 boxes that need to be looked for every investment a private equity firm makes. With really couple of exceptions, an organisation needs to have these things for a private equity firm to be interested: Self-Sufficient Management Group Minimum $3M EBITDA Favorable Capital Defensible Market Position Feasible Exit Method Remember private equity firms are merely cash managers.

Private equity firms may consider smaller companies as add-on’s. What’s the distinction between platform and add-on acquisitions? Platform acquisitions are generally investments in big companies poised for development. Platform companies are often the first significant financial investment for a private equity fund. Add-on acquisitions are financial investments made after a platform is established – titlecard capital fund.

In our work with private equity companies we have seen that an appealing incentive in getting an offer done is seller involvement in the capital structure of the company moving forward. This often takes the kind of seller funding and/or roll-over equity. Private equity companies discover these alternatives attractive since they allow the seller’s know-how to still be included in the service’ operations.

This chart shows a basic private equity offer structure: A lot of business buyers, private equity funds especially, use financial obligation even if they do not require to. Here’s why: debt increases the fund’s rate of return. Because of that, financial obligation is much more influential to private equity offers than most individuals realize. This chart lays out a basic circumstance as an example (invested $ million).

What Does A Private Equity Firm Do?

Each year after the acquisition, the financial obligation portion of the firm’s ownership reduces and the equity portion increases. In this situation the business’s appraisal has remained stable at $4,000 (although, companies usually do grow after 5 years). That implies that the firm will get $4,000 on the sale of the company.

This is since they selected to use financial obligation when they made the acquisition – $ million investors. As time went on, debt reduced, and equity grew. Without financial obligation, the firm would not have had such a strong rate of return. Even if you think private equity will never touch the ownership of your company, it matters since You’re in competitors with private equity-controlled services.