Illinois Business Broker Directory

“You also desire a broker who succeeds since that’s evidence that he or she understands the trade.” “Have to do with your monetary convenience zones and investment abilities,” she says. “There is nothing more frustrating to a broker than to find out that you do not have the means to invest.” If you have actually reached the point where you ‘d like to sell your business, think about the following questions prior to selecting a broker.

The length of time have you functioned as a business broker? Preferably, you want to deal with a broker with a track history that returns at least several years. Do you work full-time or part-time as a business broker? This concern is very important due to the fact that you wish to know whether the broker is most likely to be on the job when a concern or need arises.

A significant factor owners note their organizations for sale with brokers is to gain the utilize of an expertly managed marketing program. Beyond publishing your ad on the brokerage website, discover out how else your business will be marketed by asking these questions: In addition to your own brokerage website, what other online business-for-sale listing websites do you use? Do you place classified print advertisements for your listings? Likewise ask the broker to show you a sample of the selling memorandum (or selling book) that he or she prepares for clients so you can get a sense of the caliber of file the broker prepares and presents to buyer prospects.

Illinois Business Brokers – Percentage, Benefits, The Brokerage Process

Ask the broker for info on the following points: What method does the broker use to develop the asking rate for an organization like yours? What portion of variance does the broker encourage you to expect between the asking cost and the closing cost? Over the previous year, what’s the average percentage of asking rate received by the broker’s closed listings? When it comes to the broker’s expert credibility and reliability, you desire to understand 2 things: Has the broker ever been sued by a listing customer or a service purchaser, and if so, when and why? Does the broker carry professional liability insurance? This type of insurance secures service businesses in case a service provider is in some way negligent and a customer suffers financial damage.

Simply put, you agree not to work with a number of brokers at the same time – Free Business Valuation Aurora. The exclusive broker has sole rights to your sale for so long as the listing arrangement lasts, which is typically not less than six months. The one exception, if your broker agrees to it, is that you may work out a take or restricted exception for a specific purchaser possibility.

Unless you have a prospective purchaser waiting in the wings, this clause does not truly matter, however if you know of someone who may become your buyer, make certain to get a take written into your listing contract or you’ll pay the commission on the sale in spite of the truth that you brought the buyer to the deal.

Why Use A Illinois Business Broker?

For someplace in the variety of $1,500 or $2,000, a broker might be ready to help you get your business-for-sale files ready for presentation. Tyler Tysdal. The broker might even provide to credit the cost against the sale commission if you choose later on to note your business with him or her.

com columnists are their own, not those of Inc. com.

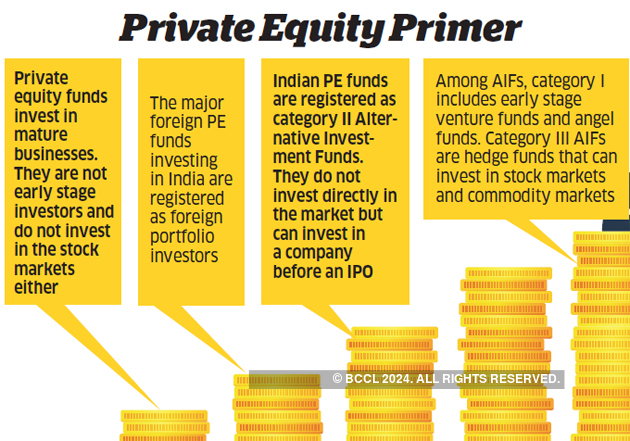

Those wanting to buy or sell a service typically question about the role of a business broker at the same time. Does it make sense to utilize the services of a broker, or are you much better off entering into the transaction on your own? How can a business broker help the seller or the purchaser throughout the deal? Business brokers are intermediaries who speak with sellers and buyers and assist assist in the sale of a personal business.

What Is A Illinois Business Broker? And Should You Use One?

Business brokers are similar in some aspects to real estate representatives, though they deal solely with the buying and selling of organizations. Business brokers work carefully with sellers from the minute they decide they want to put their business up for sale. It is best to get ready for a sale well ahead of time (as much as a year beforehand if possible) so there is adequate time to get arranged and have business all set to attract a great price.

Another important function the broker plays for the seller is marketing business for sale. Utilizing information from similar deals in the very same industry and other important factors, the broker assists set a price that the seller can be confident with. In addition, reputable brokers have access to a broad network of potential purchasers, and they utilize evaluated and proven marketing approaches to reach a large swimming pool of prospects while preserving privacy throughout the procedure.

Lots of purchasers go into the procedure with a certain business in mind, while others are unsure exactly what they want. In either case, the large number of available companies for sale can be overwhelming. A broker can speak with the purchaser to help narrow the options to the listings that best match their enthusiasm, skills, and budget.

Why Working With A Illinois Business Broker To Sell Your Business

Expert business brokers deliver value to both sides in a company transaction. They assist sellers prepare for the sale of their company and market it to the ideal purchasers, and they help purchasers find the organization that is ideal for them. Brokers have comprehensive training, experience, know-how, and an in-depth understanding of business sales process.

understands your needs and we can assist you get off to the best possible start. Our group will exercise the due diligence and get ready for all the possibilities to take into account when buying and running a business. Current market conditions, pricing, success and company funding can all affect your sale or purchase of a business.

We constantly approach a customer with a personal touch and quality of life factors to consider for things such organization hours or commute, which can frequently be neglected. If you’re selling an organization, the brokers at Buy, Or, Sell, Organization – Sell Business Peoria. com can assist you correctly value the rate of the company and evaluate the potential success and development.

Why Use A Illinois Business Broker?

Licensing Currently, there are 17 states requiring business brokers to be certified by their state’s real estate commission. All states require a real estate license if business broker is managing real estate together with the sale of business entity. Nevertheless, the bulk of little to medium size companies are in rented locations with no real estate as part of the sale.

Historically, the broker has actually generally represented the seller, however purchaser representation is ending up being more common. The representation of one party in a transaction usually creates a fiduciary responsibility between the broker and the celebration represented. Some states enable double agency representation of both purchaser and seller if all parties consent to the plan.

What Work Brokers Do? Business brokers perform many responsibilities consisting of: Rates business with an expert appraisal. Drafting an offering summary, often called a private business review. This piece ends up being one of the most essential marketing tools for the offering, and is provided to prospects just after they have signed a privacy arrangement and been qualified by the broker.

Become A Illinois Business Broker

This is one of the important identifying differences in between business brokers and real estate representatives. Real estate representatives put an indication in front of their homes and usually without the requirement for confidentiality, market widely the particular area. Business brokers are trained to preserve stringent privacy. Introducing prospective buyers to business after insuring confidentiality agreements have actually been executed.

Nevertheless, over the last few years some brokers have actually moved to a partial up front fee which might be credited to commission at closing. This assists the broker settle the initial expenses included in marketing business, and according to some brokers, likewise serves to identify major sellers as opposed to those who simply want “to test the waters,” which numerous brokers consider as a waste of their time.

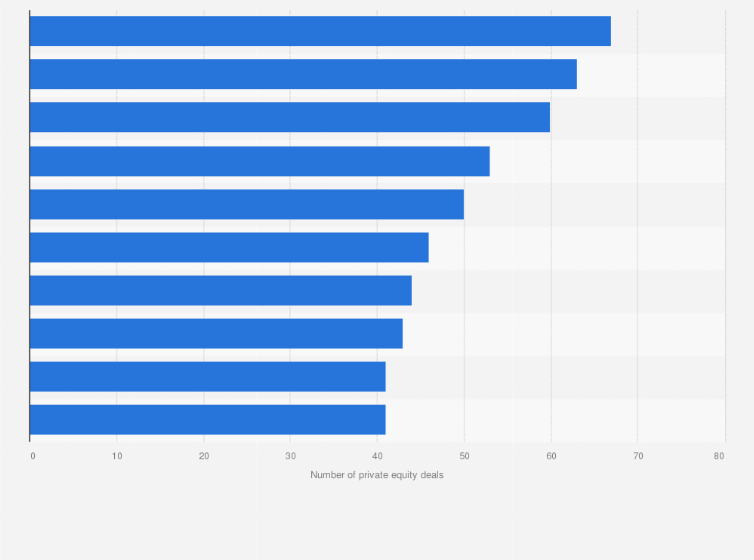

In a recent study of the profession, 59 percent of brokers reported utilizing a 10 percent commission rate. Usually, the smaller business, the higher the percentage rate of commission. Leading 3 Concerns Included in a Service Transfer Lots of business brokers concur that the leading three problems associated with the transfer of company ownership are:.

Tyler T. Tysdal Securities, Exchange Commission Gets …aznewstimesng.wordpress.com

Tyler T. Tysdal Securities, Exchange Commission Gets …aznewstimesng.wordpress.com