Again, you can mention their strong performance history, nice positioning, terrific management, and all those success factors that make you desire to join them. You will get bonus points if: – You connected to the PE firm directly without going through headhunters (shows efforts, credibility) – You get “championed” by someone working at the firm (alumni, pal).

– You dealt with a deal with the firm (as a banker or consultant, provided you succeeded!) – You dealt with companies they believed about buying (bankers and specialists: examine the all bidders for the deals on your CV!) Private Equity interviews are infamously difficult and will include a mix of healthy concerns, technical questions, mini cases and investment pitches and brainteasers. Don’t forget to contribute to your list any interesting PE firm name that you encounter. If you get welcomed to Private Equity interviews, you will generally experience Private Equity case research studies. PE case research studies can be notoriously challenging, and require a fantastic offer of preparation. While every firm will have different types of case research studies, this short article aims to offer you a summary of what you should be expecting.

Based upon your analysis you need to propose a final suggestion: should they purchase this company or sector? At what price? Case research studies are fantastic due to the fact that they enable the recruiter to examine several aspects of a prospect: The capability to take in a large amount of information and focus on what matters The capability to structure your ideas and analysis General organisation acumen Pure “problem-solving” abilities (i (pay civil penalty).e.

Case research studies can take on several forms, but these are the most common: 1. Take-home case studies: The firm will send you a case via email and provide you a few days to finish it, then send it back in a Word file with your Excel model. 2 (commit securities fraud). Mini-cases: at the firm, face to face, as a live conversation.

3. Full-blown cases: At the firm. You are seated in a space with a computer, given the case research study, and permitted between one hour to 4 hours to finish your analysis and Excel design. The ingredients of a case research study are constantly the exact same, irrespective of the format: 1. Description of a business and sector.

Financials. These can be a few key items (i.e – private equity firm. profits, EBITDA, Capex) or you can get a full yearly report or IM. Based on this info, you should be able to evaluate the business, construct an LBO design, and address the following questions: Is the company an appealing investment or not? How much should we pay for it? For case research study practice please describe our private equity case study here.

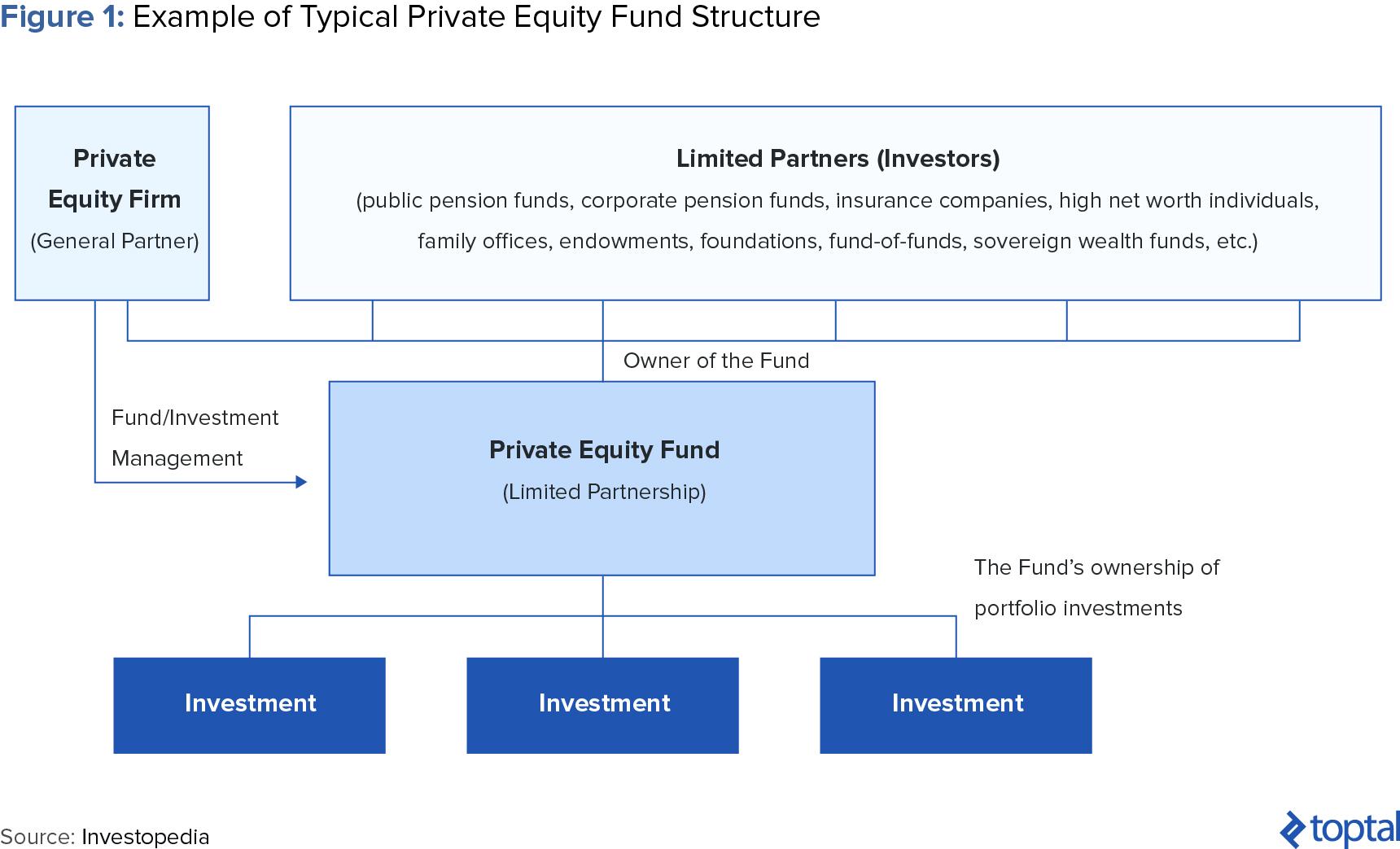

Particular funds can have their own timelines, financial investment objectives, and management approaches that separate them from other funds held within the very same, overarching management firm. Effective private equity companies will raise lots of funds over their lifetime, and as companies grow in size and intricacy, their funds can grow in frequency, scale and even specificity. For more information about private equity and - go to the websites and -.

Tyler Tysdal is a lifelong entrepreneur helping fellow entrepreneurs offer their business for maximum value as Managing Director of Freedom Factory, the World’s Best Business Broker situated in Denver, CO. Liberty Factory assists entrepreneurs with the biggest deal of their lives.

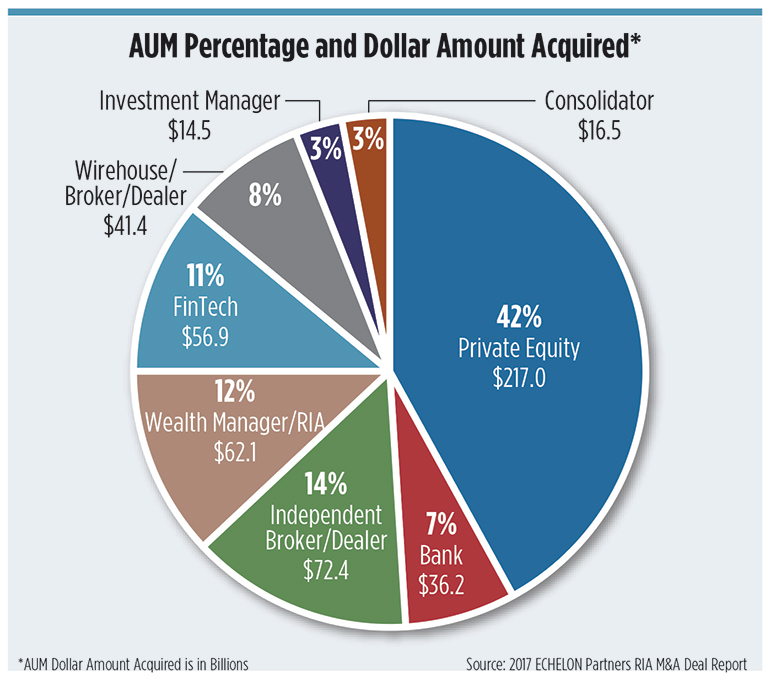

We broke down the list in “generalist” funds that cover all sectors throughout distinction locations, “sector professionals”, “specific region-focused” funds and lastly Private Equity funds within investment banks. Note that the list below covers just the significant funds and does not consist of equity capital funds and other Private Equity funds that have less than 500 countless properties under management.

3 Misconceptions Of Selling To Private Equity Firms + Lutz M&a

Apax.com) Bain Capital (www.baincapital.com) CVC Capital Partners (www.cvc.com) Cinven (www.cinven.com) Apollo Management (www.agm.com) 3i (www. 3i. com) Warburg Pincus (www.warburgpincus.com) Terra Firma (www.terrafirma.com) Hellman & Friedman (www.hf.com) General Atlantic (www.generalatlantic.com) Charterhouse Capital Partners (www.charterhouse.co.uk) Sun Capital Partners (www. SunCapPart.com) BC Partners (www.bcpartners.com) Bridgepoint Capital (www.bridgepoint.eu) Doughty Hanson & Co (www.doughtyhanson.com) TA Associates (www.ta.com) Development International (www.adventinternational.com) Clayton, Dubillier & Rice (www.cdr-inc.com) Barclays Private Equity (www.bpe.com) Duke Street Capital (www.dukestreet.com) Eurazeo (www.eurazeo.com) GI Partners (www.gipartners.com) HIG Capital Europe (www.higeurope.com) IK Investment Partners (www – private equity fund.ikinvest.com) Phoenix Equity Partners (www.phoenix-equity.com) Rhone Group (www.rhonegroup.com) Silverfleet Capital Partners (www.silverfleetcapital.com) Hg Capital (www.hgcapital.com) PAI Partners (www.paipartners.com) Cerberus Capital (www.cerberuscapital.com) Star Capital (www.star-capital.com) Montagu Private Equity (www.montagu.com) Omers Private Equity (www.omerspe.com) Arle Capital (www.arle.com) Vista Equity Partners (www.vistaequitypartners.com) Capvest (www.capvest.co.uk) Pamplona Capital Partners (www.pamplonafunds.com) Elecktra Partners (www.electrapartners.com) Inflexion Private Equity (www.inflexion.com) Providence Equity Partners (www.provequity.com) Silver Lake Partners (www.silverlake.com) Top Partners (www.summitpartners.com) GMT Communications (www.gmtpartners.com) The Gores Group (www.gores.com) Quadrangle (www.quadranglegroup.com) – Media Veronis Suhler Stevenson (www.vss.com) – Media Lion Capital (www.lioncapital.com) Neo Capital (www.neo-cap.com) J.C.

Tailoiring your CV is a critical part of the application procedure, due to the fact that it will be utilized in the numerous steps that will follow if you are welcomed for a preliminary interview. In the UK, Private Equity funds will normally try to find the following qualities in your CV: >> Organisation Judgement >> Strategic viewpoint and understanding >> Interest for investing >> Raw intelligence >> Analytical skills >> Knowledge of financing, accounting and modelling >> Strong interaction and social skills >> Presence of network or possible network, and “pedigree” >> Leadership and maturity Therefore, to be invited for a preliminary interview, you require to draw out each of those qualities on your resume.

– The large private equity funds (with $1bn or more in asset under management) such as Goldman Sachs PIA, Morgan Stanley Private Equity, Blackstone, Carlyle, and so on will tend to focus on your LBO modelling skills. This is especially real for private equity funds with teams composed of ex-bankers so examine their websites and you’ll know what to expect.

For that reason, revealing a mutual understanding of the rationale of a transaction is extremely essential to them. Anticipate consulting-style case research studies at the interview. – Small and mid-market funds will be more focused on your personality and cultural fit with the firm (tysdal lone tree). This is because for smaller firms, relationships are crucial and you will be working very close with management groups of possible target and portfolio companies.

Be cautious however, trading and selecting stock is not what private equity companies do, they are looking at the long term, so do not point out that you belong to a Sales and Trading Club.- Any management positions you’ve had is a strong positive as it shows management, maturity, great social abilities and ambition.- Lastly, do not mention anything that is irrelevant (i – indicted counts securities.