Private Equity – How Does It Work?

The finest deal experience from PE funds’ point of view is having encouraged a fund on an effective acquisition, and any experience in financing and leverage-finance work. Beware! they will barbecue you on those transactions! Also highlight sell side, purchase side, IPOs, etc that you have actually done, however offer less details than for your Private Equity-related deals.

You will score a lot of points if you dealt with due dilligence projects with PE firms. Also highlight any financial modeling you may have done, as the main disadvantage of experts is their lack of experience at building LBO designs. For all applicants, depending on the fund you are targeting, highlightings sector understanding might be a good or bad things.

FIG, TMT). Just make your due diligence on the fund you wish to use to, and customize your CV appropriately. PE funds clearly favour top-tier companies, and specifically US banks and McKinsey, BCG and Bain & Co, and they like to employ people who they worked with on transactions. Applying from a second-tier bank will definitely be a challenge (and a from a third-tier andsmall firm a major struggle), but it can be conquered if you have solid offer experience or can stand out in other areas, particularly in terms of education, languages, and fit with the firm’s culture.

In the end, you require to have a “unique flavour” that will make a distinction. fraud racketeering conspiracy. Here is a checklist of excellent things to draw out: – Activities pursue at a high level: for instance, sports are always an advantages to highlight if you’ve dipped into a professional and semi-pro level.

– If you have any burning enthusiasms, mention them, however only if you are a real expert and got concrete and excellent acknowledgment for it (i.e. prizes, discusses in journalism) – Language abilities and citizenship are constantly important for huge pan-European or worldwide funds. For pure UK funds, beware as this may well be a handicap, unless they have explicitly require someone with a particular language – fraud racketeering conspiracy.

Private Equity, Explained

– Get your CV reviews by pople that have PE experience, if you can. Just deal with a couple of individuals you rely on as getting a lot of evaluations can be complicated. – State the reality. PE interviews are typically very comprehensive and “extensive”, so there is no room to comprise anything.

– Prioritise your experiences. Take out anything that is not appropriate out of your CV, and focus on the most pertinent experiences, and explain. Omit anything that was too brief or that you would not be comfy discussing. – Use action phrases and not passive ones. “I was part of a team” is not excellent – tell them what YOU were doing – titlecard capital fund.

– You can always prepare for at least 50% of the questions that will be asked about yourself and your CV. PE equity interviews are tough to get, so invest meaningful time preparing to make the finest of it! Private Equity recruiting tends to be a lot more casual than banking or consulting, however there are some very common actions that the majority of Private Equity firms consider interviews – private equity firm.

For more information on each action, please inspect our in-depth posts on technical concerns, case research studies, and psychometric tests. – Psychometric tests These are mathematical and spoken tests (most often SHL tests, examples here) developed to finish a first cut in the applicant swimming pool. Anything in between 30% and 50% of the candidates can be declined at this stage, often more, depending upon the “pass” limit.

Make certain to ask if you will require to take these tests, as you will need some preparation. – Fit and CV concerns These concerns involve having to very first introduce your background, strolling the recruiter through your CV, and acing concerns like, “Why private Equity?” and “Why our firm?” Needless to say, you should have practiced this very well, as this is probably the most essential concern you will be asked in the interview.

Why Private Equity Firms Are Reaching Out To Specialized

This may consist of a SWOT analysis on a specific firm (really typically among their portfolio company), a financial investment rationale analysis, or asking your viewpoint on specific markets or companies. local investment fund. This could be a basic concern, such as “Do you believe an airline company would be an excellent investment?” or more comprehensive questions with supporting data and charts that you will have to evaluate.

– Technical questions These accounting or LBO concerns are nothing too tough for a skilled financial investment banking expert, but be ready to discuss how you build an LBO, evaluations of IRRs, and numerous kinds of financial obligation instruments without hesitation. This frequently includes a full-blown LBO modelling workout and investment case analysis based on an Information Memorandum or a case research study supplied by the private equity firm. denver district court.

You will then require to present your outcomes to senior members of the firm. Once again, if you are a skilled analyst and if you get some LBO modelling practice this need to not be too difficult. Prior to the interview, make sure you practice creating easy LBO designs from scratch. You must be able to pull together a simple LBO design in less than one hour, beginning from a blank page, by making affordable presumptions.

Anything can be asked; some firms might try to drill down on your perceived weak points and ask more in shape questions, you might just have a pleasant and easy chat (but do not be tricked, every response will be scrutinised), or you might be asked a great deal of extremely individual concerns. At this point, everything will boil down to your character, your career objectives, and how likeable you are as an individual.

Nevertheless, most companies will require you to satisfy everyone or at least 90% of the individuals in the fund, so be prepared for an extremely lengthy procedure that might last numerous months -and expect a minimum of 3 months from start to end up. Getting a task in private equity is often viewed as the holy grail of financing.

Private Equity Firm Hierarchy And Associate Role

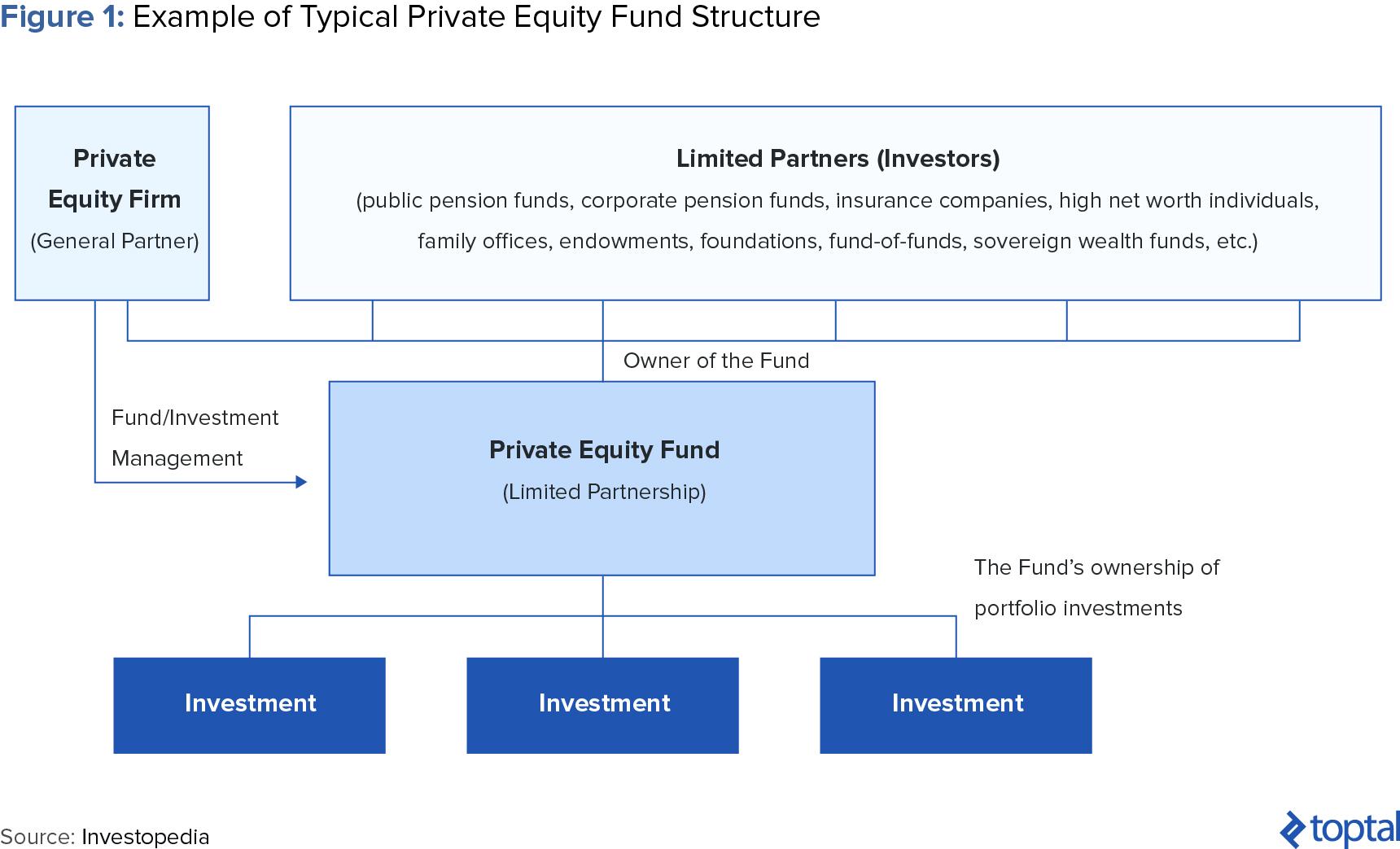

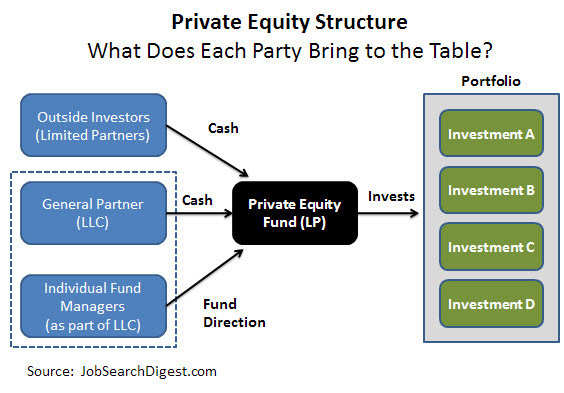

Particular funds can have their own timelines, investment objectives, and management viewpoints that separate them from other funds held within the very same, overarching management firm. Successful private equity firms will raise many funds over their lifetime, and as companies grow in size and complexity, their funds can grow in frequency, scale and even specificity. To get more info regarding private equity and also - visit the websites and -.

In 15 years of managing possessions and backing several entrepreneurs and financiers,Tyler Tysdal’s business managed or co-managed , non-discretionary, approximately $1.7 billion in assets for ultra-wealthy families in markets such as oil, gas and healthcare , real estate, sports and entertainment, specialized lending, spirits, innovation, durable goods, water, and services business. His team advised customers to buy nearly 100 entrepreneurial business, funds, personal lending offers, and real estate. Ty’s performance history with the private equity capital he released under the very first billionaire customer was over 100% annual returns. And that was throughout the Great Recession of 2008-2010 which was long after the Carter administration. He has created numerous millions in wealth for customers. However, given his lessons from dealing with a handful of the certified, extremely sophisticated people who might not seem to be pleased on the advantage or comprehend the potential disadvantage of a offer, he is back to work solely with business owners to assist them sell their companies.

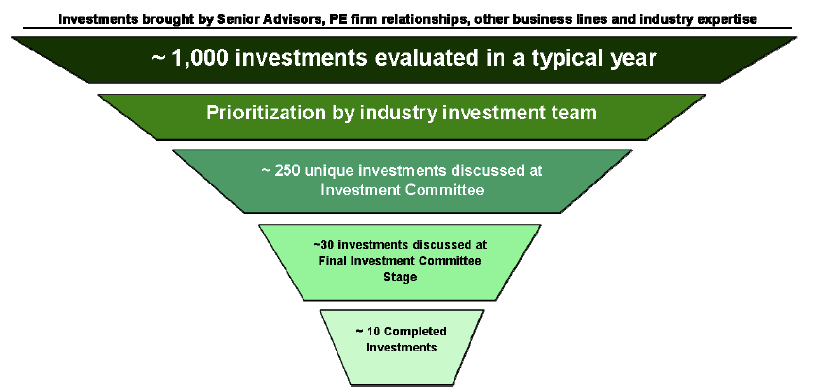

– These are generally pre-MBA candidates employed from the financial investment banks, technique consulting firms or accounting companies. They generally have 2 to 4 years’ experience optimum. – The task includes primarily prospecting (cold calling, screening sectors for fascinating business, etc.) along with investment analysis – state prosecutors mislead. This involves reading Secret information Memoradum (CIM) and other company data, working on financial models and composing financial investment memos for the investment committee.

entrepreneurship, hedge funds, business advancement, or another PE fund). – Compensation mainly includes base pay + perk. – These are often employed right out of business school or one to 2 years after graduation from service school. These experts have three to 6 years’ work experience in investment banking, consulting and private equity.

– The work consists of taking full responsibility for offer screening and modelling throughout the execution of a deal. Most of their time is invested handling consultants such as financial investment banks, legal representatives, and accountants. investment fund manager. – Payment mostly includes base pay + bonus offer, often with a small share of financial investment earnings.